The role of Francophonie within the TIWB initiative

by Camille TIRAND - Tax Advisor, Secrétariat IISF

25 July 2024

The “Tax Inspectors Without Borders” (TIWB) initiative was inspired by “Doctors Without Borders” and like the latter is dedicated to providing assistance to developing countries. Rather than providing medical aid, however, its main aim is to transfer tax audit knowledge and skills to the tax administrations of developing countries, and to improve their ability to tax multinational enterprises (MNEs) effectively in order to mobilise their domestic resources.

TIWB is a joint initiative of the Organisation for Economic Co-operation and Development (OECD) and the United Nations Development Programme (UNDP). It was launched at the Third International Conference on Financing for Development in Addis Ababa, and its Secretariat has been based in Paris from the outset. It is a unique instrument for mobilising tax revenues for development, and its results speak for themselves. Beyond the positive impact on tax revenues of the recipient developing countries, which certainly make it one of the best value-for-money development assistance initiatives, its success lies in the transfer of tax audit skills, knowledge and know-how that takes place over the course of the programmes between experienced tax inspectors (the TIWB experts) and local inspectors seeking to acquire new skills to better perform their duties. The use of a common working language is strongly advocated for each programme, hence the relevance of the French language for programmes carried out in French-speaking countries.

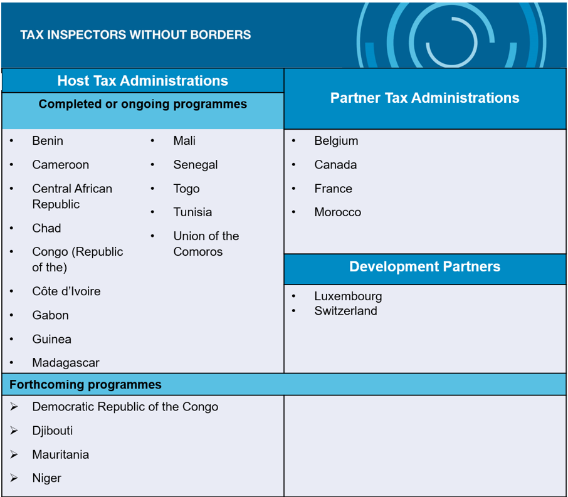

French-speaking tax administrations are an important part of TIWB, both as providers of experts and as beneficiaries of TIWB programmes. Under the TIWB initiative, experienced French-speaking tax inspectors are deployed by partner tax administrations, including Belgium, Canada, France and Morocco, to work on complex MNE audits in developing countries alongside local tax auditors. As TIWB approaches its 10th anniversary, it is clear that the French-speaking world has played an important role in forging successful partnerships that are boosting domestic revenue mobilisation in Francophone developing countries.

The benefits for TIWB of a common working language

The learning-by-doing approach at the heart of TIWB helps to ensure that tax expertise is more firmly and sustainably embedded in the tax administrations of developing countries, and complements more traditional forms of capacity building. Given that TIWB relies on real-time support for auditors, fluid and effective communication is both necessary and useful for the successful delivery of a programme.

A common working language is the best option as it enables participants in the initiative to work together more effectively, hand in hand, on specific cases. It also helps eliminate the costs of simultaneous interpretation and the translation of numerous documents. Interpersonal relations are often the key success factor in programmes, so sharing a common language can help build trust and improve the quality of discussions, as well as making them more interactive.

Given the collaborative nature of the TIWB approach, with an emphasis on peer learning, the experience gained from TIWB programmes generally benefits not just the local auditors, but also the TIWB experts. Discussions can be very rewarding for the latter as they broaden their horizons and are exposed to unique realities and challenges, in a different environment and with sometimes more limited tools.

Partnerships that help the French-speaking world flourish

Since its inception, demand from developing countries for TIWB assistance has grown steadily. To date, some 20 French-speaking African countries have requested TIWB technical assistance on international tax audits.

To meet these needs for technical assistance, TIWB can draw on the expertise, skills and know-how of French-speaking tax auditors from its partner tax administrations, who play a critical role in the delivery of TIWB programmes. The initiative can also call on industry experts from the UNDP Roster of Experts. The TIWB Secretariat's role is both to analyse requests for assistance with a view to determining a country's precise needs for technical assistance and to liaise with different partners, which requires a good understanding of the country's requestand consultation with all stakeholders.

This also allows the French-speaking world to be showcased, as several Francophone tax administrations have become key contributors to the TIWB initiative, thus helping to develop partnerships around a common working language.

One of the most successful French-speaking partner countries for TIWB programmes is France's Directorate General of Public Finances (DGFiP), which has played an effective role in the implementation of 10 TIWB programmes requested by French-speaking countries to date, including Benin, Cameroon, Central African Republic, Chad, Congo, Mali, Senegal and Togo.

Other French-speaking partner administrations, such as the Canada Revenue Agency (CRA) and the Belgian Federal Public Service (SPF) Finance, also provide TIWB with some of their most competent experts.

Furthermore, TIWB focuses on South-South tax co-operation between French-speaking countries. For several years now, the Moroccan Tax Authority (DGI) has been providing experts with particularly valuable experience to meet the capacity-building needs of French-speaking countries, such as through TIWB programmes in Cameroon and Senegal.

Indeed, co-operation between countries in the same region and which face similar challenges further increases the effectiveness of TIWB capacity-building measures. While common principles are clearly at the heart of international taxation, there are also regional similarities in the procedures underpinning MNE audits, making learning-by-doing more effective. By promoting South-South co-operation, TIWB contributes to the dissemination of good practice in tax auditing and promotes, as far as possible, the harmonisation of tax practices within the same region or sub-region. South-South partnerships can help find and share fresh solutions to common problems.

The partnership opportunities provided by TIWB contribute to greater international tax co-operation for beneficiary countries. Taking into account their capacity, countries may request tailored assistance multiple times by submitting a request to the TIWB Secretariat. Capacity building takes place gradually, sometimes through several different types of programmes or programmes targeting different sectors, as illustrated by Senegal’s experience. Senegal's Tax Administration (DGID) has been the recipient of three TIWB programmes, the first two supported by France and the third by Morocco. The first programme ran from December 2014 to December 2015. During this period, an expert from the French DGFiP worked with Senegalese officials on several cases in the transport and agriculture sectors, which enabled Senegal to recover USD 18.6 million in additional tax revenue in 2015 (from adjustments and surcharges). The second programme, which began in 2017, focused on audits in the oil, gas and mining sectors. Completed in 2019, this programme resulted in USD 30 million in tax adjustments related to transfer pricing issues. The success of these first two TIWB programmes led Senegal to apply for a third sector-specific programme, covering telecommunications, banking and insurance. In addition to the impact on Senegal’s domestic tax resource mobilisation, the programmes as a whole have enabled DGID teams to enhance their skills and knowledge in several sectors.

TIWB experts are not a substitute for local auditors. On the contrary, their role is to assist them in understanding complex international tax issues (such as transfer pricing). In addition to the fact that aTIWB expert must be qualified and experienced, he or she must generally be familiar with the industry being audited (banking and insurance, extractives, telecommunications, etc.). For example, Guinea's tax administration (DNI) has received technical expertise from the Canada's CRA in auditing extractive activities, drawing on its proven experience in addressing issues specific to this sector.

A springboard for development

TIWB serves as a platform for developing international co-operation and partnerships. In this context, TIWB programmes are opportunities for collaboration between several international and regional organisations with French-speaking resources. A TIWB programme can build on other capacity-building activities previously conducted by the OECD, UNDP or other international/regional organisations.

One noteworthy feature is the presence and support of strategic partners such as the African Tax Administration Forum (ATAF), with success in Africa largely driven by close collaboration with ATAF. Accordingly, TIWB programmes can complement ATAF’s broader engagement with one of its member countries in Africa. The Cercle de Réflexion et d'Échange des Dirigeants des Administrations Fiscales (CREDAF) also actively supports French-speaking programmes and when member countries report a need for technical assistance, the information can then be passed on to the TIWB Secretariat. The Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) is also able to provide very specific expertise to certain programmes.

The presence of these partners therefore offers new opportunities for international co-operation and a degree of complementarity between various tax capacity-building initiatives, including those implemented by the OECD, from which French-speaking countries can benefit with a view to better mobilising their domestic resources. For example, there are several French-speaking countries that have received or continue to receive OECD assistance under both bilateral and TIWB programmes.

Table of francophone countries within the TIWB initiative

Conclusion

To date, TIWB technical assistance to French-speaking developing countries has focused mainly on MNE tax audits and, in the future, it can be expected to extend to new areas such as criminal tax investigations and automatic exchanges of information between other tax administrations in jurisdictions where these developing countries require assistance.

Going forward, against a backdrop of expanding both the intensity and diversity of technical assistance, TIWB plans to continue its work with French-speaking countries. In this respect, the participation of as many French-speaking countries as possible in the initiative is essential to its success, whether as partners or host administrations. By working together, we can increase the impact of our technical assistance and promote sustainable and inclusive development across the entire community of French-speaking countries.

Related Documents