Tax Inspectors Without Borders helps developing countries bolster domestic revenue mobilisation and remains open for business despite COVID-19 challenges

by Rusudan Kemularia, Head of TIWB Secretariat (see biography)

30 September 2020

Tax Inspectors Without Borders (TIWB) was launched in July 2015 to strengthen developing countries' auditing capacity and multinationals' compliance worldwide. Five years on, this OECD/UNDP initiative is more relevant than ever as fiscal space tightens as a result of the current health pandemic. I am deeply honoured to have been appointed as the new Head of the TIWB Secretariat. I would like to pay tribute to my predecessor, James Karanja, and the wider TIWB team, whose work contributed so much to the early success of the initiative.

To date, Tax Inspectors Without Borders has helped recover over half a billion US dollars in tax revenue. Our latest annual report shows that TIWB programmes represent excellent value for money: for every dollar spent on TIWB operating costs, USD 70 in additional revenue have been recovered by participating countries.

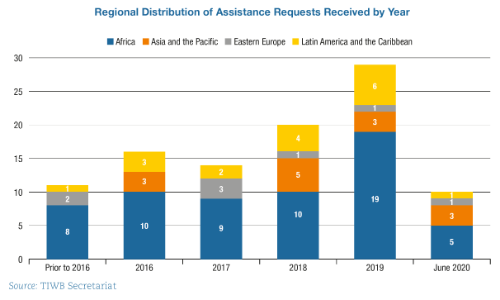

Although the COVID-19 crisis is presenting many challenges for developing countries, I am pleased to see demand for TIWB growing, an indication that tax compliance by multinational enterprises remains a top priority for developing countries. Now more than ever, international co-operation will be crucial to meet these needs and ensure a level playing field.

I am sure TIWB will play an instrumental part in this work through the delivery of capacity building on real audit cases, helping countries effectively mobilise domestic resources for achieving the Sustainable Development Goals.

I know from my time as Vice Finance Minister of Georgia how important it is to get practical help with quick wins that can build confidence to address the complexities of international taxation. This is why I believe strongly in the TIWB mandate and its ambitions for the future.

Despite the challenges posed by COVID-19, TIWB programmes remain fully operational and will continue to expand across the globe beyond 2020, thanks in particular to the support from our donors and partner administrations who supply our experts. Looking ahead, our goal is to take the initiative into exciting new areas such as tax crime investigations, the effective use of data shared through automatic exchanges and support to treaty negotiations. I want the initiative to be agile and responsive to ever changing needs and to maximise gender equality.

I look forward to putting my skills and experience at work to support the TIWB initiative and assist countries to tackle tax evasion and tax avoidance, so that together, we can emerge stronger from the COVID-19 crisis.

► Read more about TIWB in our Annual Report released on 28 September 2020.

Related Documents