How can the Tax Inspectors Without Borders initiative help developing countries overcome COVID-19 economic repercussions?

by Rusudan Kemularia, Head of TIWB Secretariat (see biography)

21 April 2021

In 2008, the financial crisis shed light on the depths of tax evasion and avoidance, prompting the need to shore up international co-operation and bolster domestic resource mobilisation to gain self-reliance and weather external shocks. This inspired the creation of Tax Inspectors Without Borders (TIWB), an initiative to help developing countries to collect taxes due to them from multinational enterprises (MNEs) operating in their jurisdiction. TIWB programmes focus on building tax audit capacity to ensure sustainable and long-term knowledge transfer to developing country tax administrations.

Six years after TIWB’s appearance on the tax and development scene, the world - especially developing and emerging economies - is facing dire economic repercussions due to the global COVID-19 pandemic. Important industries for developing countries, namely tourism, hospitality, and trade, are most affected from the crisis1. For the first time in a decade, extreme poverty is expected to increase with over 100 million people around the globe estimated to be entering more precarious economic circumstances due to the ongoing crisis2. This economic stagnation requires a swift and effective fiscal response to put global economies back on track. Fiscal stimuli in developing countries are primarily financed by steep debt increases, which comes at a time of already rapidly increasing debt in emerging and developing economies3.

With its niche mandate and a track record of quick and effective revenue collection for tax administrations, TIWB can help countries overcome COVID-19 economic repercussions. Thanks to TIWB and other tax audit capacity building initiatives in the mining sector, the Mongolian Tax Administration issued its first transfer pricing tax assessment in late 2020 for approximately USD 228 million and a denial of USD 1.5 billion in carried forward losses. The Tax Act ("tax assessment") was reported by the taxpayer’s parent entity on 23 December 2020 and although the matter currently remains under dispute, this represents a significant milestone and step forward for the Mongolian Tax Administration in executing its strategy to combat tax base erosion and profit shifting (BEPS) in the mining sector.

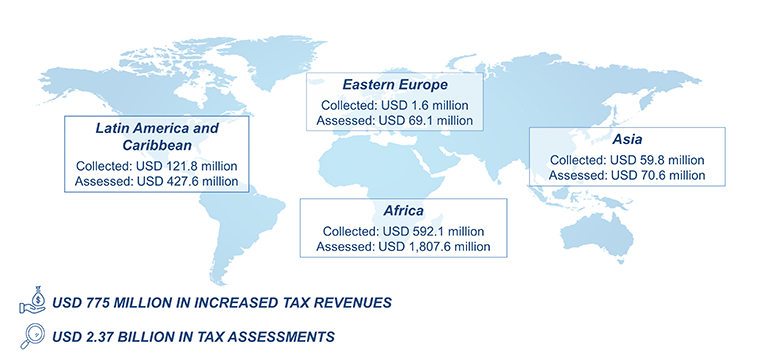

Moreover, since 2012, TIWB audit assistance, including anonymised casework conducted during joint workshops with the African Tax Administration Forum, the OECD, and the World Bank Group has led to impressive results in terms of increased tax revenues and tax assessments. A total of USD 775 million in additional tax revenues collected and USD 2.37 billion in additional tax assessed are attributed to these programmes across Africa, Asia, and Eastern Europe, as well as Latin America and the Caribbean4.

As the world looks ahead to uncertain times, taxation represents the most sustainable source to ensure development. In supporting revenue authorities build greater tax audit capacity, TIWB assistance is more relevant than ever, and the Secretariat stands ready to help developing countries overcome COVID-19 economic repercussions.

1 UNCTAD (2020), Impact of the COVID-19 pandemic on trade and development: transitioning to a new normal, United Nations Conference on Trade and Development, United Nations Publications, https://unctad.org/webflyer/impact-covid-19-pandemic-trade-and-development-transitioning-new-normal

2 WBG (2021), Updated estimates of the impact of COVID-19 on global poverty: Looking back at 2020 and the outlook for 2021, World Bank Group, World Bank Blogs, https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-looking-back-2020-and-outlook-2021

3 IMF (2020), Caught by a Cresting Debt Wave, International Monetary Fund, Finance & Development, Vol. 57, Number 2, www.imf.org/external/pubs/ft/fandd/2020/06/COVID19-and-debt-in-developing-economies-kose.htm

Related Documents