Global Initiative: Tax Inspectors Without Borders

by Ms. Rusudan Kemularia - Head of TIWB Secretariat

20 December 2023

Reflecting on her five-year tenure as the Head of the Tax Inspectors Without Borders (TIWB) Secretariat, Ms. Rusudan Kemularia examines the achievements of the initiative and shares her perspective on what lies ahead.

The TIWB initiative has evolved immensely over the last five years and is extremely well-positioned in a complex international landscape. The initiative's unique features1 have guided its implementation well so far. TIWB has experienced rapid growth and demonstrated some significant results for developing countries, particularly in terms of additional tax revenues.

From 2019 to 2023, jurisdictions benefitting from TIWB and TIWB-style support experienced notable improvements in both tax collection and assessments. A total of USD 2.07 billion in additional taxes has been collected, with an additional USD 4.94 billion in taxes assessed to date by TIWB host administrations. These achievements have been accomplished in partnership with the African Tax Administration Forum (ATAF) and the World Bank Group (WBG).

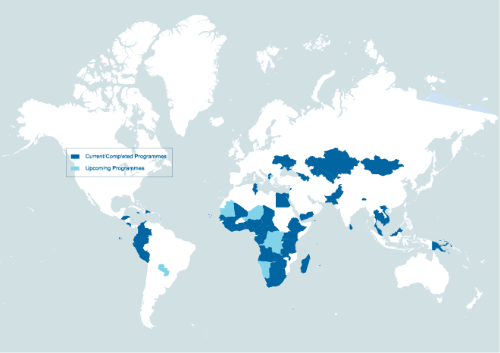

Requests for TIWB programmes continue to increase - from 47 programmes at the beginning of 2019 to the launch of the initiative’s 100th programme in 2022. Momentum has continued throughout 2023, with growing demand across all regions. To date, the initiative spans 62 jurisdictions, with 59 ongoing and 71 completed programmes. South-South programmes have also multiplied, with such collaboration on 25 TIWB programmes, compared to 7 South-South programmes in early 2019.

Geographical spread of TIWB programmes as of December 2023

To meet this growing demand, the TIWB Roster of Experts was renewed this year with both experienced serving and former tax officials. Since 2019, eight additional partner administrations have dedicated their resources to the initiative. Currently, the TIWB initiative counts on the support of 24 partner administrations, which deploy their serving officials as experts to implement TIWB programmes worldwide.

In addition to providing support to transfer pricing audits, it has been exciting to witness the growth of the initiative in new areas. Programmes focusing on the reinforcement of criminal tax investigations (TIWB-CI) across four continents is one impressive development. Leveraging the technical expertise of the OECD and the ground-level presence of UNDP country offices has made these programmes a new success story in the fight against illicit financial flows.

Pilot programmes on the effective use of automatic exchange of financial account information (AEOI), complementing the work of the OECD's Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) are also underway.

In 2024, we hope to see TIWB support the practical implementation of the global minimum tax rules, Pillar Two of the OECD/G20 BEPS Project, aimed at ensuring that large MNEs are subject to an effective tax rate of 15% on their profits in every jurisdiction where they operate. In the next year, TIWB will also look at the practical and appropriate use of Country-by-Country reporting (CbCr), which provides global access to information about multinational enterprises and is a valuable mechanism for identifying base erosion and profit shifting (BEPS) and high-level transfer pricing risks.

Finally, TIWB is piloting audits of value added tax (VAT) on digital trade. As e-commerce continues to grow and diversify, practical implementation of OECD standards and guidance for addressing the challenges of collecting VAT on digital trade will allow governments to secure critical VAT revenues and ensure a level playing field between e-commerce and traditional businesses, without stifling innovation or economic growth.

TIWB seeks to launch 25 new programmes in 2024, expanding its offer with South-South partners in response to developing countries' demands, and initiating new mentoring programmes, focusing on increasing the participation of female experts from developing countries. In collaboration with other development partners, the initiative will continue to empower developing countries to achieve greater fiscal sustainability, ultimately leading to stronger, more resilient economies.

I would like to extend my sincere gratitude to all TIWB host administrations, partners, experts, donors, and OECD/UNDP colleagues for their unwavering commitment and support in recent years. In January, I will be taking up a new position at the Global Forum. My successor at the TIWB Secretariat will be announced soon. I trust the initiative will continue to thrive and enhance the capacity of tax administrations to fully reap the benefits of the 21st century international tax reforms.

[1] Key features: short-term niche international tax assistance based on confidentiality arrangements, auditing/investigating actual cases, with a demand-driven, learning by doing approach with no substitution of host administration officials.

Related Documents