Programmes

Responsibility for ensuring that necessary funding is in place to meet the costs of a TIWB Programme resides with the Host Administration. These costs should be considered in respect to the anticipated impact of the audit assistance programme. By drawing on its network of Donor Partners, the TIWB Secretariat is able to assist Host Administrations connect with potential Donor Partners and Partner Administrations who may have the capacity to fund all or part of the costs of the TIWB Programme.

In most cases, Host Administrations contribute to funding the costs of the TIWB Programme and should be viewed as a means of engaging ongoing and high-level commitment to the TIWB Programme's objectives by the Host Administration.

Key links

Duration of assistance

There is no minimum or maximum period for TIWB Programmes. Each Programme is likely to be at least one week long and may, for example, provide 8 to 12 weeks of audit assistance over a period of 18 to 24 months. Before making an Assistance Request, Host Administrations should consider precisely how and when an Expert would engage with their audit cycle and with the audit plans for particular taxpayers.

Timing of assistance

A practical matter to consider is the timing of the expert assistance in order to accomodate both parties' schedules. The TIWB Expert should be present on-site in the Host Administration in order to have maximum effect. This will mean taking into account audit planning, tax return cycles, the time normally taken to complete particular types of audits, including peak work periods in the audit process.

Mode of assistance

TIWB Programmes will vary according to need and availability, but will mostly be structured as Periodic Programmes. The TIWB Expert provides intermittent on-site assistance, such as 6 weeks of assistance provided over a 18-month period in the course of 6 in-country visits. In some cases, this periodic assistance will be coupled with remote desk-based assistance when the Expert is not present in the host country.

Status

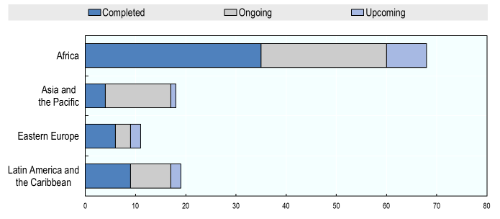

TIWB programmes are currently underway in various countries and jurisdictions to support audit activities. Experience proves that TIWB-style audit assistance can result in improved quality and consistency of tax audits; sustained improvements in tax audit skills; and higher levels of voluntary compliance by taxpayers. South-South deployments are also a growing element of TIWB programmes.

Completed programmes - 59 |

Current programmes - 54 |

Upcoming programmes - 14 |

Current Programmes

Honduras (2)

Start date: April 2021

Host Administration:

Servicio de Administración de Rentas(link)

Expert: Serving tax officials

Partner Administration:

Servicio de Administración Tributaria(link)

Mexico

International Partner(s):

Inter-American Center of Tax Administrations

UNDP Country Office: Honduras(link)

Tunisia

Start date: July 2020

Host Administration:

Direction générale des impôts(link)

Expert: Serving tax official & former tax official

Partner Administration:

Direction Générale des Finances Publiques(link)

France

International Partner(s):

Co-financed by the European Union

UNDP Country Office: Tunisia(link)

Yemen

Yemen

Start date: July 2022

Host Administration:

Tax Authority of Yemen

Expert: TIWB Roster Expert

Partner Administration:

N/A

International Partner(s):

N/A

UNDP Country Office: Yemen(link)

Zambia (3)

Start date: December 2018

Host Administration:

Zambia Revenue Authority(link)

Expert: Industry expert

Partner Administration:

N/A

International Partner(s):

Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF)

UNDP Country Office: Zambia(link)

Upcoming Programmes

The following countries and jurisdictions have made formal requests for assistance to the Tax Inspectors Without Borders (TIWB) Secretariat. We are currently seeking qualified experts to be deployed as part of the TIWB Programmes below. Please contact the TIWB Secretariat directly to find out more on how your tax administration can be involved in the success of a TIWB Programme!

Completed Programmes

Egypt (1)

Dates: Jan 2017 - May 2019

Host Administration:

Egyptian Ministry of Finance(link)

Expert: TIWB Roster Expert and Egyptian tax expert

Partner Administration:

N/A

International Partner(s):

Co-financed by the European Union

Programme Outcome Report(pdf)

Egypt (2)

Dates: Dec 2019 - Feb 2023

Host Administration:

Egyptian Ministry of Finance(link)

Expert: TIWB Roster Expert

Partner Administration:

N/A

International Partner(s):

Co-financed by the European Union

Programme Outcome Report(pdf)

Ethiopia (2)

Dates: November 2018

Host Administration:

Ethiopian Revenues and Customs Authority(link)

Expert: Industry expert

Partner Administration:

N/A

International Partner(s):

N/A

Programme Outcome Report(pdf)

Gabon

Dates: Nov 2019 - Dec 2021

Host Administration:

Direction Générale des Impôts(link)

Expert: TIWB Roster Expert

Partner Administration:

N/A

International Partner(s):

N/A

Programme Outcome Report(pdf)

Honduras (1)

Dates: March 2020 - April 2021

Host Administration:

Servicio de Administración de Rentas(link)

Expert: TIWB Roster Expert

Partner Administration:

N/A

International Partner(s):

N/A

Programme Outcome Report(pdf)

Jamaica (3)

Dates: July 2019

Host Administration:

Tax Administration Jamaica(link)

Expert: Industry Expert

Partner Administration:

N/A

International Partner(s):

Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF)

Programme Outcome Report(pdf)

Peru (1)

Dates: Oct 2016 - Sept 2017

Host Administration:

Superintendencia nacional de administracion tributaria(link)

Expert: Former tax officials

Partner Administration:

N/A

International Partner(s):

World Bank Group

Programme Outcome Report(pdf)

Zimbabwe (1)

Dates: Feb 2016 - Sept 2019

Host Administration:

Zimbabwe Revenue Authority(link)

Expert: Former tax officials

Partner Administration:

N/A

International Partner(s):

African Tax Administration Forum (ATAF) / World Bank Group

Programme Outcome Report(pdf)

Note: Programmes with an asterisk (*) indicate pilot programmes in new areas.

Colombia (3)

Colombia (3)

Dominican Republic

Dominican Republic

Kosovo (2)

Kosovo (2)

Malaysia (1)

Malaysia (1) Maldives (2)

Maldives (2) Mauritius

Mauritius

Nigeria (2)

Nigeria (2)

Sierra Leone*

Sierra Leone*

Thailand

Thailand Togo

Togo

Azerbaijan

Azerbaijan Benin (2)

Benin (2)

Cameroon (3)

Cameroon (3)

Paraguay

Paraguay

Central African Republic

Central African Republic

Côte d'Ivoire

Côte d'Ivoire

Madagascar

Madagascar

Mali

Mali

Rwanda

Rwanda Ukraine

Ukraine